Discover Just How a Home Loan Broker Can Facilitate Your Secondly Count On Action Funding

Protecting second count on deed financing can be an intricate undertaking, calling for both tactical understanding and market understanding. A home mortgage broker acts as an important ally in this process, leveraging their experience to connect the gap in between lending institutions and borrowers. By evaluating your financial profile and straightening it with suitable loaning options, they ensure that the course to financing is both certified and efficient with regulatory requirements. Yet what special advantages do brokers use, and how can they transform your funding trip into a seamless experience? Discover the critical function they play in enhancing your monetary end results.

Understanding Secondly Trust Actions

When it concerns property funding, a second depend on act acts as a vital instrument for debtors looking for additional funds while retaining their existing home mortgage. Basically, it stands for a secondary finance protected versus the borrower's home, subordinated to the primary mortgage. This economic tool is specifically beneficial for those requiring to gain access to equity without re-financing their first home loan, which may have favorable terms or incur high prepayment penalties.

In practice, a 2nd trust fund deed entails the borrower pledging their residential or commercial property as collateral, just as they finished with their main home loan. It comes with higher interest rates due to the enhanced danger for lending institutions; they stand behind the first mortgage in case hierarchy need to repossession happen. Regardless of this, second depend on acts give an adaptable option for house owners looking to fund home renovations, settle financial obligation, or cover substantial expenditures.

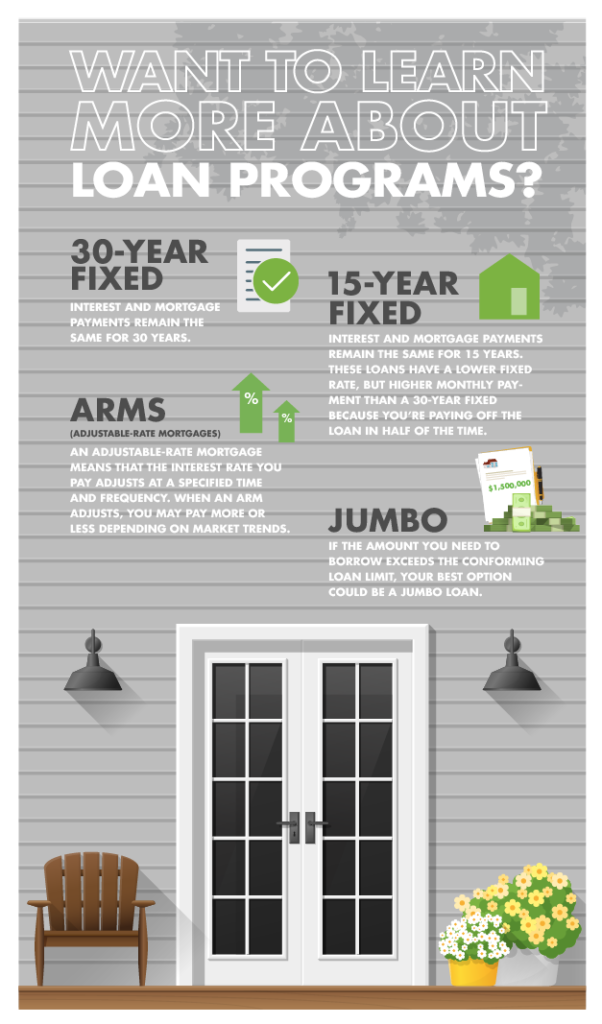

Debtors have to work out due diligence when considering this option, reviewing their financial capability to manage extra debt (jumbo loan). Understanding the effects of the loan's terms, such as rates of interest, payment routines, and loan provider fees, is important. It makes certain debtors make notified choices that align with their wider monetary method

Function of a Home Loan Broker

A mortgage broker plays a critical function in navigating the intricacies of second trust fund deed funding. As an intermediary in between loan providers and consumers, a broker improves the often elaborate procedure associated with protecting a 2nd trust deed. They have the know-how to assess a customer's economic circumstance and identify suitable borrowing choices, making certain compatibility with certain economic objectives and restraints.

The home mortgage broker's responsibilities consist of reviewing a wide selection of loan products from various lenders. This enables them to provide tailored suggestions and present options that align with the consumer's one-of-a-kind requirements. By leveraging their sector relationships, brokers can negotiate desirable terms and affordable rate of interest on part of the customer. This arrangement power is critical in the greatly uncontrolled landscape of 2nd count on actions, where terms can vary substantially.

Benefits of Using a Broker

Using a home loan broker for second trust deed funding frequently uses considerable benefits to customers. One key advantage is access to a broad network of loan providers, which increases the possibility of safeguarding desirable terms. Home mortgage brokers possess industry know-how and partnerships with numerous banks, allowing them to recognize the most suitable alternatives tailored to private requirements. This access can be particularly beneficial for customers with special monetary situations or those seeking affordable rates of interest.

Along with giving access to a broader selection of lending institutions, brokers conserve borrowers significant time and initiative. They handle a lot of the research, from researching Learn More Here possible loan providers to putting together necessary paperwork, hence simplifying the process. This efficiency permits borrowers to focus on various other concerns while ensuring that their financing demands are being addressed by a specialist.

In addition, mortgage brokers use customized advice throughout the funding journey. Overall, engaging a home loan broker can streamline the complex landscape of second depend on deed financing, supplying tangible advantages to customers.

Browsing the Application Process

Navigating the application procedure for second count on deed funding needs cautious interest to detail and a strategic strategy. As a borrower, comprehending the nuances of this procedure is important for protecting favorable terms.

Following, analyze your financial objectives to figure out just how the second count on action aligns with your more comprehensive monetary method. It is vital to plainly verbalize these goals to your home loan broker, as they will tailor their guidance as necessary. A well-prepared application not just demonstrates reputation yet additionally streamlines the approval procedure.

Last but not least, continue to be positive throughout the procedure. Immediately react to any ask for added information from your broker or lending institution to preserve momentum. This diligence can substantially influence the rate and success of your financing approval.

Tips for Picking the Right Broker

Choosing the ideal home loan broker is similar to discovering the perfect overview this content via a complicated monetary landscape. The broker you choose will certainly play an important function in securing positive terms for your second depend on deed financing. To ensure you make an educated choice, consider these vital tips.

First, verify the broker's qualifications and experience. A seasoned broker with a tried and tested track record in second count on acts can provide vital understandings and experience. Check their licensing and any affiliations with credible sector companies, which typically indicate a dedication to specialist requirements.

Next, evaluate their interaction abilities and responsiveness. A great broker ought to be readily available to answer concerns and supply updates. Clear and open interaction is essential in browsing the elaborate information of property funding.

Conclusion

Using a home mortgage broker for second trust deed financing offers numerous advantages, consisting of structured processes, accessibility to a large network of lenders, and the negotiation of competitive rates of interest. With experience in assessing financial circumstances and making certain governing compliance, brokers improve the possibility of protecting positive car loan terms. Their involvement minimizes the intricacy and time view it financial investment for customers, making them an important resource in accomplishing financial objectives connected to second trust actions.

A home loan broker plays a critical role in browsing the complexities of second depend on deed funding. Acting as a liaison between consumers and loan providers, a broker enhances the usually complex procedure included in protecting a second trust fund act.Making use of a mortgage broker for second trust fund deed funding regularly provides considerable advantages to consumers. In general, engaging a mortgage broker can simplify the complicated landscape of 2nd depend on deed funding, supplying concrete advantages to debtors.

Making use of a home mortgage broker for second trust deed funding deals countless benefits, consisting of streamlined procedures, access to a wide network of loan providers, and the negotiation of affordable interest prices.